Banks make money from interest rate spreads, relying predominantly on instruments such as the yield curve. They borrow at the short-end, paying out lower interest rates to their lenders (short-term bank deposits), and then lend out to others at the long-end (long-term bank loans, mortgages, etc.).

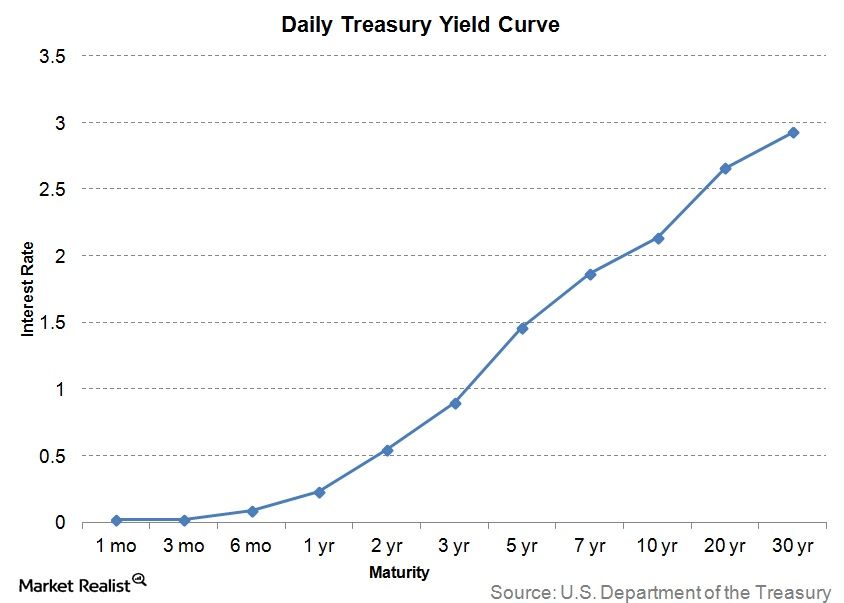

Above is a typical upward sloping yield curve, with long-end interest rates higher than the short-end due to the longer term having higher volatility and an increase in inflation.

Everything in finance assumes that as risk increases, the return compensated to investors to take on that risk also increases. Hence, the phrases 'high risk, high return' and 'low risk, low return'. In the same sense, the long-end provides a higher return due to the higher volatility which implies higher risk.

However, if the yield curve inverts, it reduces banks' ability to make money, as we can see nowadays with a flattening yield curve and negative interest rates at the short-end. The flattening yield curve is reducing the spread (profit opportunity) available to banks, whereas the negative interest rates disincentivize deposits as a whole. At first glance, this may seem highly counterintuitive and strange, but in deflationary environments, central banks want to increase consumption instead and therefore shift the price of money to lenders instead.

How does the short-end and long-end move up and down? The short-end is controlled by the Federal Reserve setting interest rates through reserve ratios and open-market operations i.e. buying or selling government Treasury bills. Buying government T-bills in large quantities increases demand, which in turn increases prices. Price and yield are inverted, so buying T-bills decreases yield.

It can also be thought of through money supply. Buying T-bills increases the money supply, which in turn causes lower interest rates (lower yields).

- Market controls long end - buy more, price goes up, yield goes down (fed might do this to allow for companies to

- Lending is locked in at given rates - for corporates

- Yield curve inversion and pricing

- https://www.frbsf.org/education/publications/doctor-econ/2004/july/yield-curve/

- Trading the yield curve - bond fund trading strategies

- https://www.pimco.com.hk/en-hk/insights/viewpoints/negative-rates-negative-view/?gclid=CjwKCAjwoc_8BRAcEiwAzJevtW6YWRCIQLau_rZpXPA3etU0OdXCvUTIXFumQogCoMQDqpDyRJsIjxoCjlAQAvD_BwE&gclsrc=aw.ds&